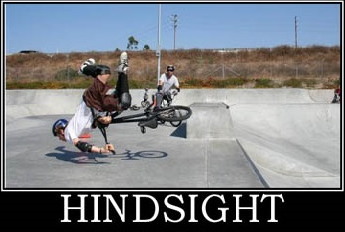

Over and over again traders fall for the trap of having too much hindsight. It is not just the new traders that I am referring to but experienced traders alike. No matter how long we have been trading for, it is very easy to fall into the “could have… should have” mentality.

For example, say we entered a bullish trade on the US dollar because the macro factors support a stronger dollar. We may have spotted a double top formation but neglected it as we believe that the fundamental forces should prevail in the long run. Next thing we know the US dollar enters a period of free fall and the trade quickly loses a lot of money.

In this situation it is very easy to go back in time (in our mind) and accuse ourselves of neglecting the double top formation that indicates a price fall. In reality our trades may have a two year time frame and short term technical analysis would probably have little effect on the outcome. Still when the trade starts losing money we start thinking, “I could have delayed my entry and got in at a lower level”.

Consequently, the next time we see a double top formation, we ignore the fundamentals and close the trade straight away, not wanting to make the same mistake again. This time though the trade reverses and rallies through the roof.

Call it conspiracy or call it karma, but the market does have an interesting way of teaching us lessons.

The thing with hindsight is that we look back at an event and see it as something that is bound to happen, given the facts at that time. That is not necessarily true.

Imagine a coin flip. Say we flip a coin and it turns up heads. Just because it did turn up heads doesn’t mean that it was bound to turn up heads. If we happened to go back in time and flip the coin again, probability theorem tells us that there is a 50/50 chance that the coin could turn up heads or tails (okay maybe the sci-fi guys might argue with me).

If something as simple as a coin flip could have two random outcomes, the markets with all their complex mechanisms would obviously have multiple random outcomes also. The one that happened is only one of many outcomes that may not repeat in the future.

It always bothers me to hear someone say I told you so as if the actual outcome is the only outcome that was bound to happen. With a different outcome, I told you so could easily be ‘oops’ and vanish into thin air.

Don’t get me wrong, the idea is not to abandon the analysis and due diligence process as that is what separates traders from gamblers, and lets us learn from our true mistakes. Instead, it is important to realise that the outcome we observe is only one of many possibilities, and future trades with the same facts may not have the same outcome.

Recognising the bias from having too much hindsight is important because otherwise we are prone to keep changing our strategy to try to trade perfectly. Unfortunately with trading there is no perfection as there always remains an element of luck at the end of the day.

The way that we succeed is to stick with strategies with a proven edge and make minimal alterations to our strategies. Any changes would require careful consideration on how any change would have affected all of our trades using the same strategy, rather than how it could have benefited just one trade.

As traders we are constantly bothered by our lack of foresight and the curse of having too much hindsight. The lack of foresight is something that we all recognise and that is why we seek further education and guidance from people whom we think have better foresight than ourselves.