I will be commencing my coverage of a Foreign Exchange trading strategy that is strictly rule driven from technical analysis and indicators. The strategy is based on the concept of what is known as ‘Parabolic Stop and Reverse’ which essentially is a trend based trading strategy.

I will be releasing a daily note of the Forex positions I currently hold and the stop loss levels that will be updated in the day on a daily basis based on the movements of the currency pair the night before.

The strategy has proven successful in the past through back testing. This strategy requires patience and the ability to stock to the rules! If you believe you can follow these two things, there is a good chance that you can see some decent returns.

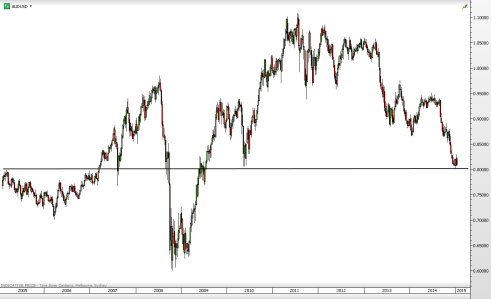

This is a chart that the strategy is based off where we either get given ‘Buy’ or ‘Sell signals based on the red dots. If the dot is below the candle, we buy the currency and place our stop loss at the level of the red dot beneath it. On a daily basis the stop is moved to the dot below the corresponding candle. In this case we would buy AUDNZD and set our stop loss at the level of the red dot below the latest candle.

In foreign exchange profits and losses are calculated in points. Foreign exchange is has a margin rate of 1%, meaning that if you want exposure to $100,000 of a currency you will have to put aside $1,000 of margin in your trading account.

P/L e.g: If the AUDUSD moves from 0.9000 to 0.9010 for example, this is a move of 10 points and this would constitute a profit or loss of $100.00 on a $100,000 position.

These are my current positions and equivalent information if all trades were followed:

- AUD/USD (Daily) Latest 0.9033 LONG from 0.9113 on 18/03 Reversal point at 0.8963.

- 1045 points realised profit since 01/13 if all trades followed.

- EUR/USD (Daily) Latest 1.3778 SHORT from 1.3866 on 19/03 Reversal point at 1.3938.

- 294 points realised profit since 01/13 if all trades followed.

- EUR/JPY (4 hour) Latest 141.110 LONG from 141.760 on 20/03 Reversal point at 140.830.

- 3434 points realised profit since 01/13 if all trades followed.

- GBP/USD (Daily) Latest 1.6506 SHORT from 1.6597 on 12/03 Reversal point at 1.6666.

- 1326 points realised profit since 01/13 if all trades followed.

- USD/CAD (Daily) Latest 1.1243 LONG from 1.1118 on 10/03 Reversal point at 1.1098.

- 1110 points realised profit since 01/13 if all trades followed.

- USD/JPY (Daily) Latest 102.400 SHORT from 102.320 on 13/03 Reversal point at 102.590.

- 1095 points realised loss since 01/13 if all trades followed.

If all trades were followed from 01/2013 last year the total profit would be 6114 points.

If we held a $100,000 position in each of these pairs this would relate to a $61,140.00 profit.

Remember only $5,000 margin would be needed for this. I would recommend an account size of $20,000 to take up positions this size so we were able to ride the ups and downs of the currency market. Of course we could do this with $10,000 positions and the margin necessary would only be $500.00. I would recommend an account size of $2500 in this case.

Please contact me to look into establishing an account and following this strategy if you are interested.

LP